Get the free 956a form download

Show details

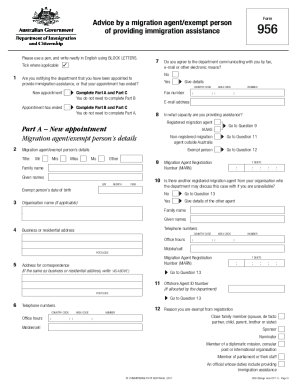

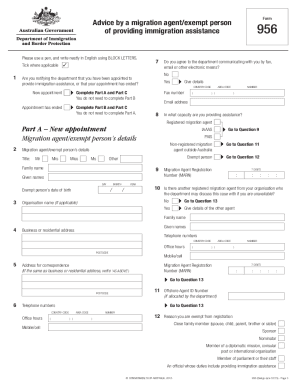

Appointment or withdrawal of an authorized recipient Who should use this form? This form should be used to notify the Department of Immigration and Citizenship (the department) that you are: appointing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 956a form

Edit your form 956a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 956a form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 956a form sample filled online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 956a form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 956a appointment

How to fill out 956a form:

01

The first step is to carefully read through the instructions provided with the form. These instructions will guide you on how to correctly complete each section of the form.

02

Make sure to gather all the necessary documents and information before starting to fill out the form. This may include personal identification documents, proof of address, and any other supporting documents required.

03

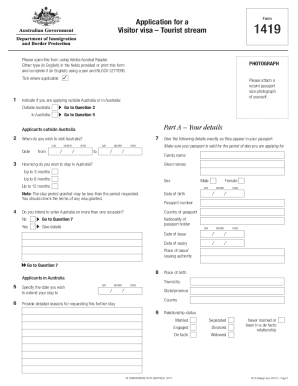

Start by filling out your personal information in the designated sections of the form. This includes your full name, date of birth, gender, nationality, and contact details.

04

Next, provide information about your current passport. This includes the passport number, issue and expiry date, and the issuing authority.

05

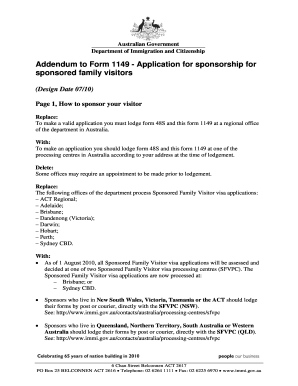

If you have previously held any Australian visas, you need to provide details about them in the relevant section of the form. This includes the visa subclass, grant number, and the dates of previous visits to Australia.

06

In the declaration section, carefully read through the statements and tick the appropriate box to indicate your agreement or understanding.

07

Finally, review all the information filled in the form to ensure accuracy and completeness. Sign and date the form before submitting it along with any required supporting documents.

Who needs 956a form:

01

The 956a form is required for individuals who are applying for an Australian visa or extension of their stay.

02

It is also necessary for individuals who are sponsoring or nominating someone for an Australian visa.

03

The form may also be needed by immigration agents or representatives who are acting on behalf of their clients in visa-related matters.

Fill

form 956a appointment or withdrawal of an authorised recipient

: Try Risk Free

People Also Ask about form 956a fill online

Do I need to fill form 956A?

If you wish to appoint a migration agent or another person to receive information about your application, please complete Form 956 or Form 956A. This can be done via your ImmiAccount (for online lodgements) or by completing the forms below (for paper applications only).

Do I need to submit form 956A?

If you wish to appoint a migration agent or another person to receive information about your application, please complete Form 956 or Form 956A. This can be done via your ImmiAccount (for online lodgements) or by completing the forms below (for paper applications only).

Who is the exempt person to provide you with immigration assistance?

An exempt person is someone who is not a registered migration agent or legal practitioner and is one of the following: your nominator or sponsor. your close family member. a parliamentarian.

What type of assistance is form 956?

A separate form 956 Appointment of a registered migration agent, legal practitioner or exempt person must be completed for each matter. Where your appointment has ended, this form can also be used to notify the Department of the withdrawal of your appointment as an authorised recipient.

How do I fill out form 956A online?

Here's how it works Edit your 956a online. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Share your form with others.

What is a 956 visa form?

A separate form 956 Appointment of a registered migration agent, legal practitioner or exempt person must be completed for each matter. Where your appointment has ended, this form can also be used to notify the Department of the withdrawal of your appointment as an authorised recipient.

Who fills out 956A form?

If a person 16 years of age or older wants to appoint a different authorised recipient they should complete a separate form 956A. The Department may use a range of means to send documents to your authorised recipient.

What is 956A form for?

This form should be used to notify the Department of Home. Affairs (the Department) that you are: • appointing an authorised recipient to receive documents. that the Department would otherwise have sent to you; or.

What type of application is form 956?

A separate form 956 Appointment of a registered migration agent, legal practitioner or exempt person must be completed for each matter. Where your appointment has ended, this form can also be used to notify the Department of the withdrawal of your appointment as an authorised recipient.

What is the use of form 956A?

If you wish to appoint an authorised person such as a dispatcher, travel agent or another person to receive documents that the department would otherwise have sent to you, complete Form 956A Appointment or withdrawal of Authorised Recipient.

What is the purpose of form 956A?

Department of Home Affairs Who should use this form? withdrawing the appointment of your authorised recipient. Return the completed form to the office where you lodged your application or for any other matter (eg. proposed visa cancellation), to the office of the Department that is responsible for that matter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify download 956a form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 956a form australia into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit 956 a form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 956a form download and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out 956a form download using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 956a form download and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is 956a form?

The 956a form, officially known as Form I-956A, is a form utilized by entities seeking to file an application for a regional center under the EB-5 Immigrant Investor Program.

Who is required to file 956a form?

Entities that wish to operate as regional centers and are seeking to participate in the EB-5 Immigrant Investor Program are required to file the 956a form.

How to fill out 956a form?

To fill out the 956a form, applicants must provide detailed information regarding their organization, proposed business plan, job creation strategy, and investment strategies while adhering to the instructions provided by USCIS.

What is the purpose of 956a form?

The purpose of the 956a form is to enable the U.S. Citizenship and Immigration Services (USCIS) to assess regional center applications and ensure they meet the necessary eligibility requirements under the EB-5 program.

What information must be reported on 956a form?

The 956a form requires reporting of key information such as the name and address of the regional center, the business plan, projected job creation, investment strategies, and the legal structure of the entity.

Fill out your 956a form download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

956a Form Download is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.